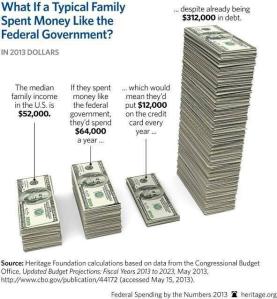

As a country, the U.S. has behaved like the proverbial 18-year-old college student with access to too many credit cards — we want it, we can’t afford it, but we get it, anyway. Damn the money, that is what debt is for. We can worry about that another day. Until the next time, and the next, and then there is an emergency… (Before any finger-pointing begins, both parties, even the “small government” Republicans, are equally guilty of overspending.)

If we each brought our bag of taxes to Washington personally, we might be more invested in how it is spent.

Read any political article today and you can find a million ways to talk about money: taxes, subsidies, funds going to programs domestically and causes overseas in amounts we can’t fathom. We can’t fathom them, so we don’t. After all, it is just government money, and the government has access to A LOT of money.

It is time to stop, take a breath and change how we think about government spending.

Consider how individuals and families think about their money, their budgets, their income, their debt, their savings. This is a very personal, sometimes emotional and stressful, topic. Is there enough money? How can the budget be stretched? If there is a new or unexpected expense, how do we accommodate it? Do we cut somewhere or go into debt?

It is very difficult for anyone to think about a government budget with the same concern, the same personal consideration one would give to a personal budget, but I think this is where we must try.

We all pay our taxes. For the middle class, these taxes are significant in proportion with our “living money,” or the amount of income we actually get to spend on living. Once this money leaves our paychecks or our checking accounts, it goes into the great, enormous pile of money in Washington and/or our state capitols. We largely forget about it, other than vague desires to spend the pile one way or another, or to NOT spend it. The “personal” side of the money is gone. Well, what if it wasn’t? What if your taxes stayed in a bundle with your name on it and so did everyone else’s?

The average 4-person family in the U.S. makes $67,019/year. Average EFFECTIVE tax rate paid by middle class Americans is 12.9%. So let’s assume, after standard deductions, that the average 4-person family pays around $6,220 in taxes per year. (This is Federal taxes only. Remember, this same family also pays plenty of other taxes: property taxes — either directly as homeowners or indirectly as renters — sales tax, state income tax, payroll taxes including Social Security and Medicare tax, gas tax, motor vehicle tax, etc. We will keep it simple and discuss only Federal income tax.) So let’s use this as our standard of measure:

$6,220 = One family’s Federal income taxes for one year

Let’s look at the retirement pension for a Congressperson who served for 20 years, which is an average of $70,620. That Congressperson is receiving the entire amount of more than 11 families’ taxes for the year, every year, to be retired. If they receive this pension for 15 years, they are taking 171 families’ taxes, to be retired. So your family, and my family, and 169 other families bundled up our hard-earned money, wrapped it up with our names on it and sent it to this Congressperson to enjoy during their retirement. This Congressperson is no longer contributing to the system in any way, and this is only one of the 280 Congresspersons getting this average amount! And our money, mine and yours and 169 other families, is not going toward roads or infrastructure or medical research or paying down the debt or doing any good at all.

Need another example?

In 2012, the U.S. Department of Agriculture paid out $20.3 million in 239 different Farm Subsidy OVERPAYMENTS (as in, at least 50% over the amount that was due). (More info about farm subsidies and why both parties dislike them here and here.) That is the equivalent of 3,264 families’ taxes, wasted on overages. To add a little more sting, farms owned or partially owned by three members of Congress received subsidies totalling $7.6 million over a 13 year period. So those members of Congress, who are already receiving

taxpayer money as salary and stand to gain a congressional pension, also accepted the Federal income taxes of 1,222 families in the form of farm subsidies. One thousand, two hundred and twenty-two families’ money. And (last one, I promise) the Department of Agriculture sent out $22 million in farm subsidy payments to 3,400 policyholders who had been dead more than two years. That is equal to the Federal taxes of 3,536 4-person families. That is like taking the Federal taxes of an entire town. Yours, mine, all your neighbors, all your extended family, all the families at your job, all the families whose kids go to the same school as your kids or your grandkids, all your closest friends and double that. Or triple or quadruple it. All those people and their families carefully packed their $6,220 and sent it to the Department of Agriculture, to send to people who have been dead for two years or longer.

Is it personal yet?

How would it feel to work hard all year to pay your taxes only for it to go to something wasteful or something equally useless? Wouldn’t you want to protest and say: “I’d like my money to DO something! I worked for it, please don’t waste my hours away from my family!”

This is the way we need to start thinking about the way government spends money. I will discuss money from now on translated into “# of families’ annual taxes.” Some may argue that corporations pay taxes, and so do the wealthy, and do we really care how THEIR money is spent? Truthfully, it is ALL our money. When you buy an Apple product, you are helping Apple pay its corporate taxes. When you buy a Microsoft product, you are contributing to Bill Gates’ wealth. Financially, we are all connected and we need to start taking ownership of the way our money is being spent.

Many people and organizations like to tackle an issue and ignore the money side. After all, this Next New Idea is amazing and we will all love it and benefit! The money? Well, it is pretty expensive and with our current debt picture, it might be tough. But that will work itself out somehow. Right? The truth is, nothing in this country gets done without your money and my money and your sister’s family’s money and your kids’ future earnings and maybe the money you wanted to leave your kids. It is easy to ignore this and charge ahead spending. Don’t we all know That Guy who buys a lot on credit, feels no obligation toward that debt once he has his hands on the new Porsche or bling or extravagant vacation, and continues to buy more without looking back? We need to change this mindset and make every single political decision based on the fact that we are using OUR money. You may be very conservative with your own money and budget but feel government money works differently. It doesn’t.

In order for the government to be good stewards of your money (and mine), it needs to make some serious changes and we, as voters and taxpayers, need to insist on it. It needs to function within a budget. Avoid adding debt. Intelligently cut wasteful spending. Pay down the debt we have. In other words, make no moves, pass no policy, unless it makes fiscal sense. Can we afford it? If not, we can’t have it. Passing policy first and then scrambling for more income to pay for it makes no sense. When individuals do things like this, they become mired in unsustainable debt and likely move on to bankruptcy, where the taxpayers pick up the tab. Individuals (usually) have no way to drastically increase income unless they take on a second job. If the U.S. government was a person, “Sam” would need to run out and get 7 more jobs.

Enough is enough. Smaller, less expensive government is the only way out of our mess. It is called “fiscal responsibility,” and it is possible. We need to start today.